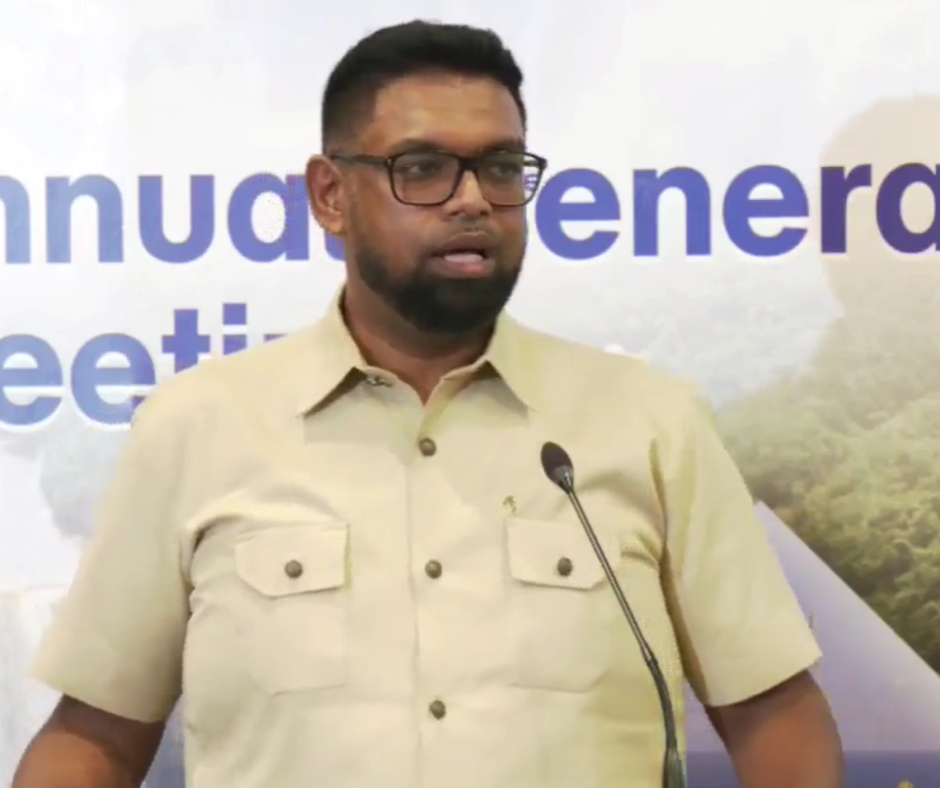

The local banking sector has come under fire for its inefficiency in assisting the private sector in exploiting the business opportunities present in the country. President Dr Mohamed Irfaan Ali, in his remarks at the Private Sector Commission’s 32 Annual General Meeting yesterday, admonished the local banking sector for its lack of responsiveness in supporting capital formation in Guyana

“The Banking Sector has been given one of the most dynamic platforms to support capital formation in this country yet to date the banking sector has not responded with the speed, efficiency, reliability, and time to exploit the opportunities that are here in Guyana.”

The President also reminded the banking sector of its critical role in driving economic growth in the country.

“The role of the bank is not to take deposits and lend in a low-risk environment. The bank’s role is also to seek opportunity, understand where the economy is going, create an ecosystem to support where the economy is going, and build upon what is happening in the country.”

The need for local banks to employ investment bankers as part of their organizational structure who will be dedicated to helping clients identify and develop business opportunities (particularly in the non-oil sector) and working with the private sector to make those opportunities a reality, was also underscored by the Head of State.

The list of licensed commercial banks in Guyana includes Republic Bank Limited, Guyana Bank for Trade and Industry Limited (GBTI), Bank of Nova Scotia, Demerara Bank Limited, Citizens Bank (Guyana) Incorporated and Bank of Baroda (Guyana) Incorporated.